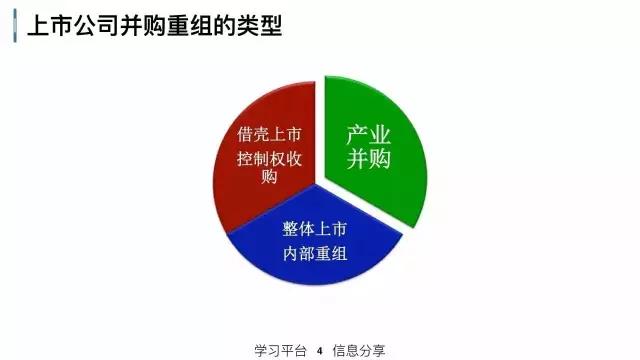

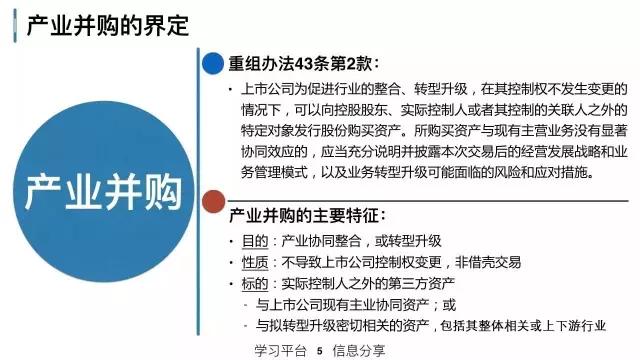

从并购的动机出发,大致分为三类:一是以借壳上市为目的的股权置换式收购;二是以整体上市为目的的资产注入式并购;三是以产业整合和产业价值提升为目的的资产重组与并购,第三种方式即所谓的产业并购。与借壳上市和整体上市为目的的并购活动相比,产业并购在决策主体、并购目的和并购方式上都区别于前两者,进而在价值创造活动中也体现出其独特的作用。

因此,从长期看:第一,产业并购可以通过财务的协同、管理的协同以及文化的协同等提升企业的内在价值。第二,以产业整合为目的的并购也是与我国产业结构调整升级相伴而生的、并将在一个较长的时期内成为并购市场的主流。